Estate Planning Conversations with Family

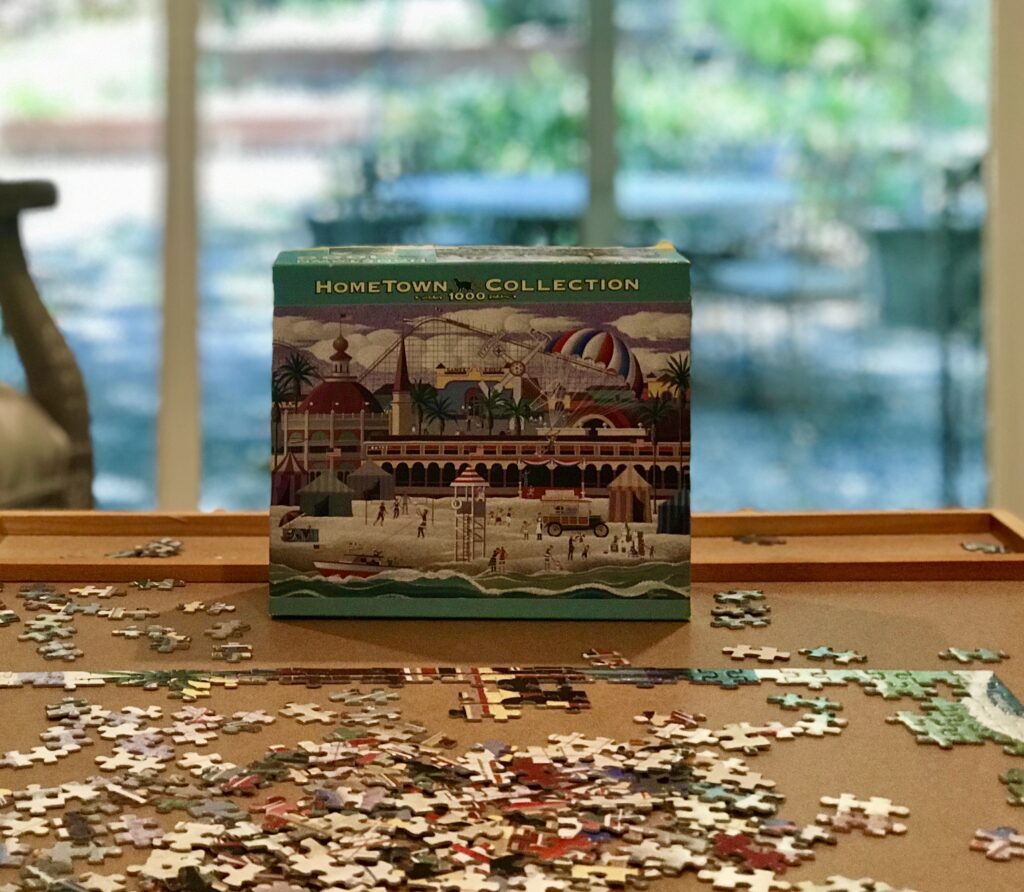

Shelter-in-Place (SIP) is an excellent time to bring back Sunday fundays! This past Sunday our family decided to put together a Hometown Collection “Santa Cruz Holiday” one thousand piece puzzle. Although we have never attempted such a feat, we thought, what the heck, let’s give it a try.

Although we haven’t completed the puzzle yet, we do keep it on the coffee table in the living room to work on it when we can. As we continue to work on it, we have loads of fun chatting. It’s a special time for sharing about our lives, including reminiscing about growing up in Northern California and visiting places like the Santa Cruz Beach Boardwalk. It also has been an excellent time to discuss sensitive topics, including wishes for after death.

Through this experience, I’ve come to realize that life is a puzzle and loving is accepting the pieces that come your way. While some pieces are harder to place than others, one thing’s for certain, the connections we make matter. At the end of the day, love and connection is what matters most to many. And that’s why having an estate plan that works is important. An estate plan not only protects your loved ones, it also provides harmony in the family even after you are gone.

According to a 2019 Caring.com Survey, 57% of adults in the United States do not have an estate plan in place, such as a will or trust, despite the fact that 76% believe in the importance of having a plan. Many owe not having an estate plan to procrastination, while others mistakenly believe it is not necessary because they do not have enough assets to warrant a plan.

An Estate Plan offers more than just planning for your assets and money. An estate plan enables you to plan for contingencies. For example, a time when someone is needed to help manage your health care decisions and financial affairs.

There’s no better time than now to ensure that your estate plan is current and up to date with your wishes. It’s also a great time to touch base with your family members, especially elderly parents, about creating an estate plan. Although Estate planning is often a difficult topic to broach, creating a proper estate plan can provide significant peace of mind for your loved ones by protecting their life savings, ensuring a plan in the event they fall ill, and providing arrangements on how they wish to pass on their property. Creating an estate plan now can eliminate future stress and uncertainty.

SIP makes it challenging for getting together and talking in person if you’re not already living together. Zoom or Facetime type features on a smartphone can make it possible to broach these topics virtually face to face or maybe you might want to just keep it simple and make an old fashioned phone call.

Here are a few tips to start the conversation and important talking points:

Validate feelings.

An approach is to open the conversation by mentioning the real need for a plan in case of illness or other contingencies. When chatting with your loved ones, listening without judgement goes a long way. Explain that in the event of an illness, having a plan will promote communication with doctors and enable the appointed agent under the Durable Power of Attorney to manage their finances. From that point, the conversation can naturally flow to how an estate plan will enable wishes on how life savings will provide for the care of any children or pets while also minimizing taxes and legal fees. It is important to communicate that having written instructions regarding a loved one’s medical care and property will make it easier in the long run to honor their sentiments.

Engage other members of the family.

If you are planning to speak to your parents about the need for an estate plan, it is important to include any siblings in the discussion. While all families have different dynamics and relationships, it is helpful to include as many immediate family members as possible to promote trust and to dissuade the impression that you are trying to influence your parents’ decisions. You and your siblings should come together and emphasize the importance of an estate plan to ensure that your parents’ wishes are known and honored if they become ill or pass away.

Address several key topics.

- Ask if your family members have a last will and testament and/or a trust. Explain that if they do not have these important legal documents, state law will determine who will receive their property and distributions might not occur the way they prefer. Sadly, a court may appoint a conservator over their affairs and/or appoint a guardian to care for their children without the benefit of reviewing a nomination established by the person in question for those roles. Having an estate plan that expresses their wishes will prevent anxiety and confusion while maintaining protection for loved ones.

- A financial power of attorney allows an individual to be appointed to manage finances and property in case of contingencies. Ask your family about their powers of attorney. Encourage them to decide who would be the best agent for the job in case the need arises.

- Make sure that your family members have an advanced health care directive. An advanced health care directive contains preferences for their medical care in case of incapacitation. It also enables them to designate a trusted person or panel to make health care decisions on their behalf when they are unable to speak for themselves.

- Ask about any insurance and the location of the insurance policies. It is important to have information about parents insurance in order to file claims for health, disability, and long-term care benefits. It’s also important to have insurance information for life insurance, homeowner’s insurance and auto insurance. The time to modify or terminate homeowner’s or auto insurance may arise.

- The list of all of their accounts and property and place the information in a binder, in a safe, or online on a secure server for safekeeping. Important personal information, including bank and investment accounts, titles to vehicles. deeds to homes, credit card accounts or loans, digital accounts (such as Facebook, Twitter, Netflix) and passwords, Social Security cards, passports, and birth certificates, should be included.

- A list of contact information for legal, financial, and medical professionals who have a relationship with members of your family is important. Be sure they include medical doctors and care providers, financial advisors, insurance agents, CPAs or tax professionals, business partners, care providers, and more.

At the Law Offices of Rosanna Chenette, P.C. we work with you to ensure that there is a plan in place for your care in case of illness, to provide peace of mind that your loved ones are protected and that your wishes will live on and be honored.